Introduction

In oncology, where treatment paradigms evolve rapidly, access to specialized, up-to-date pharmaceutical content is essential. Digital Native Platforms (DNPs) like Hidoc, with its 20,000 registered US oncologists and 13,000 active users, are becoming indispensable tools for oncologists seeking tailored clinical insights.

“This article explores how Hidoc and other platforms cater specifically to oncology professionals, comparing their effectiveness in driving engagement with cancer-focused pharmaceutical content.“

The Role of DNPs in Modern Oncology Practice

Oncologists face unique challenges, including complex treatment protocols, fast-evolving drug approvals, and the need to balance efficacy with toxicity management. DNPs address these needs by offering:

- Oncology-Specific Content: Guidelines, drug trial data, and adverse event management.

- Interactive Clinical Tools: Dose calculators, immunotherapy response predictors, and genomic profiling resources.

- Community Collaboration: Tumor board-style case discussions and expert-led oncology webinars.

Hidoc’s Oncology-Centric Engagement

“Hidoc Dr. platform is designed exclusively for oncology professionals, resulting in high engagement.”

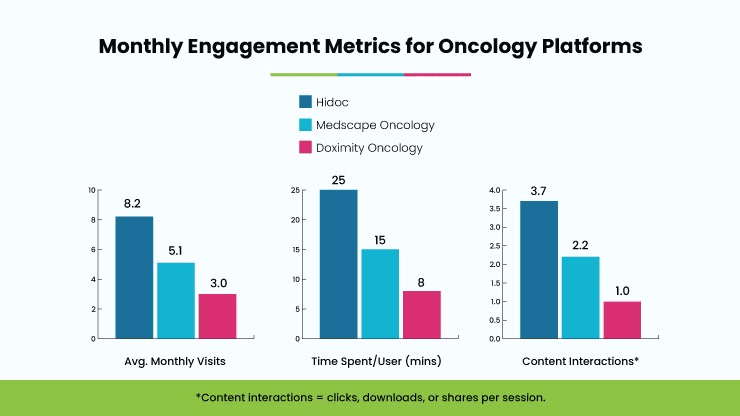

Below are metrics reflecting its niche focus:

Comparative Analysis: Oncology-Focused Platform Features

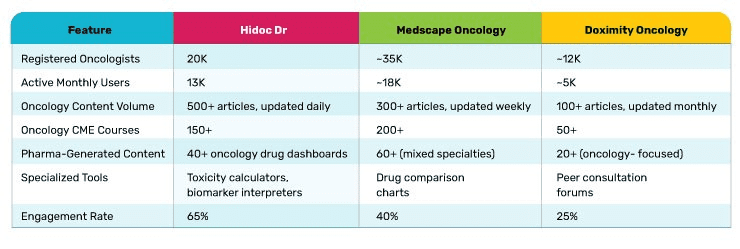

The table below compares Hidoc, Medscape’s oncology vertical, and Doximity’s oncology segment:

Key Takeaways:

- Hidoc: Dominates in daily updated content, specialized tools, and user engagement.

- Medscape Oncology: Offers broader CME but lacks depth in interactive oncology tools.

- Doximity Oncology: Focuses on peer networking but trails in curated content and pharma partnerships.

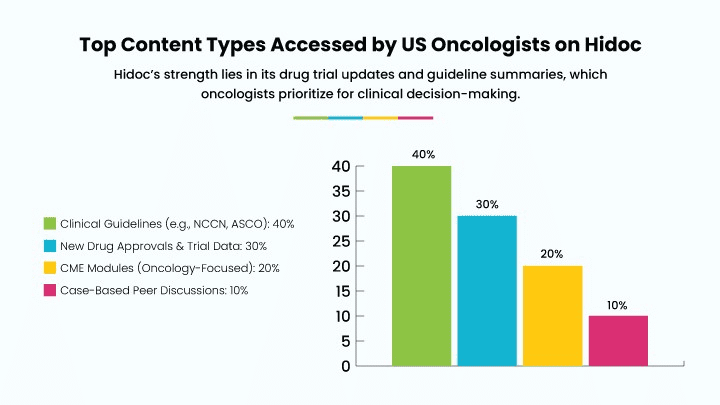

Why do Oncologists Prefer Hidoc?

- Hyper-Specialization: 85% of Hidoc users report relying on the platform for FDA oncology article alerts, compared to 50% on Medscape.

- CME Relevance: 70% of Hidoc’s CME modules are oncology-specific, versus 45% on Medscape.

- Pharma Collaboration: Hidoc partners with 5+ oncology-focused pharma companies to deliver real-time trial data, including immunotherapy response rates and combination therapy insights.

Challenges in Oncology-Focused DNPs

- Content Accuracy: Rapidly changing data (e.g., biomarker-driven therapies) requires rigorous vetting.

- Platform Fatigue: Oncologists may split time between multiple tools (EHRs, DNPs, journals).

- Regulatory Hurdles: Ensuring pharma-sponsored content complies with FDA promotion guidelines.

Future Directions for Oncology Engagement

- AI-Powered Personalization: Predicting content relevance based on patient demographics (e.g., breast cancer vs. glioblastoma specialists).

- Real-World Evidence (RWE) Integration: Embedding RWE from cancer registries into drug efficacy dashboards.

- Virtual Tumor Boards: Expanding Hidoc’s case discussion feature to include global experts.

Conclusion

For US oncologists, Hidoc’s laser focus on oncology content, tools, and community sets it apart from competitors. While Medscape and Doximity offer broader networks,

“Hidoc’s ability to deliver timely, actionable insights aligns with the fast-paced demands of cancer care.”

As precision medicine grows, DNPs that prioritize oncology specialization will remain critical to clinical practice and pharma engagement.

Appendix:

- Sources: Platform-reported oncology user stats, surveys of US oncologists (2023).

This oncology-focused analysis highlights how DNPs are tailoring solutions to meet the unique needs of cancer specialists, driving smarter clinical decisions and more effective pharma partnerships.

The Oncodoc team is a group of passionate healthcare and marketing professionals dedicated to delivering accurate, engaging, and impactful content. With expertise across medical research, digital strategy, and clinical communication, the team focuses on empowering healthcare professionals and patients alike. Through evidence-based insights and innovative storytelling, Hidoc aims to bridge the gap between medicine and digital engagement, promoting wellness and informed decision-making.