Introduction: Beyond Traditional Digital Engagement

In the high-stakes field of oncology, pharma marketing can no longer afford to operate on autopilot. What worked a decade ago, banner ads, generic webinars, and blanket email blasts, now barely registers in the minds of oncologists. The landscape has shifted dramatically. The arrival of digital therapeutics, biomarker-driven protocols, and patient-empowered decision-making means that clinical relevance has become the new currency of engagement.

Oncologists of today are not merely passive consumers of advertising. They are digitally savvy, time-constrained professionals who expect precision from pharma communication just as they do from patient treatments. They look for readily relevant, evidence-based, bite-sized information that fit easily into their decision-making process.

Furthermore, the rise of multidisciplinary tumor boards, value-based care models, and patient advocacy movements means oncologists are now looking beyond molecule-level data. They want tools that help them manage holistic patient journeys, from diagnosis to survivorship, from shared decision-making to patient adherence support.

For pharma marketers, this shift demands a complete mindset reboot. The challenge is not just to be visible but to be indispensable. It’s about embedding value at every digital touchpoint, whether it’s a quick-reference dosage calculator, a patient education toolkit, or real-world evidence dashboards that answer local treatment dilemmas.

This article delves into next-generation oncology marketing strategies, showcasing how pharma brand managers can move beyond superficial engagement metrics and focus instead on driving clinical decision impact, building lasting HCP relationships, and enabling better patient care outcomes. Because in oncology, where every message can influence life-saving decisions, marketing must evolve from mere communication to genuine contribution.

Section 1: Understanding the Digital Fatigue Among Oncologists

Oncologists today are drowning in information. In line with a recent HealthEdge Research survey (2024):

· The amount of digital pharmaceutical communications overwhelms 82% of oncologists.

- Only 14% find most branded content clinically useful.

- More than 60% prefer resources that help in real-time patient management over promotional material.

Reasons Behind Digital Fatigue:

- Excessive emailers, WhatsApp forwards, and webinar invitations.

- Content skewed toward product promotion rather than clinical support.

- Lack of localization and patient-type segmentation.

Key Insight for Marketers: Oncologists don’t want more messages. They want better, more relevant, and patient-focused information.

Section 2: Shifting Focus to Decision-Impact Moments

Traditional pharma campaigns often measure success in terms of impressions, CTRs, and reach. However, oncology marketing demands new KPIs, ones that reflect real decision support.

Strategic Pivot Areas:

| Old Metric | New Metric |

| Email open rates | Frequency of decision tool usage |

| Webinar attendance | Time spent on clinical case content |

| Impressions | Follow-up consultations initiated |

| CTR | Changes in prescribing behavior post-engagement |

Example: Instead of tracking how many oncologists opened your immunotherapy newsletter, track how many downloaded your “Treatment Algorithm for EGFR-Mutated NSCLC”.

Section 3: Mapping HCP Needs Across Oncology Practice Stages

Oncologists engage with pharma content at different stages of their patient care cycle:

| Practice Stage | HCP Content Need | Pharma Marketing Opportunity |

| Diagnosis | Diagnostic algorithm aids | Interactive biomarker testing tools |

| Treatment Planning | Comparative efficacy insights | Real-world evidence infographics |

| Patient Counseling | Education material | Patient explainer videos |

| Managing Side Effects | Quick-reference safety guides | Mobile alerts for new AE data |

| Follow-up & Survivorship | Long-term monitoring data | Survivorship care checklists |

Actionable Tip: Customize campaigns based on where the HCP stands in the patient management process.

Section 4: Leveraging Regional Insights for Personalized Oncology Marketing

India’s oncology care ecosystem is as diverse as its population. Understanding these regional nuances is no longer optional, it’s essential for pharma marketers aiming for relevance and resonance.

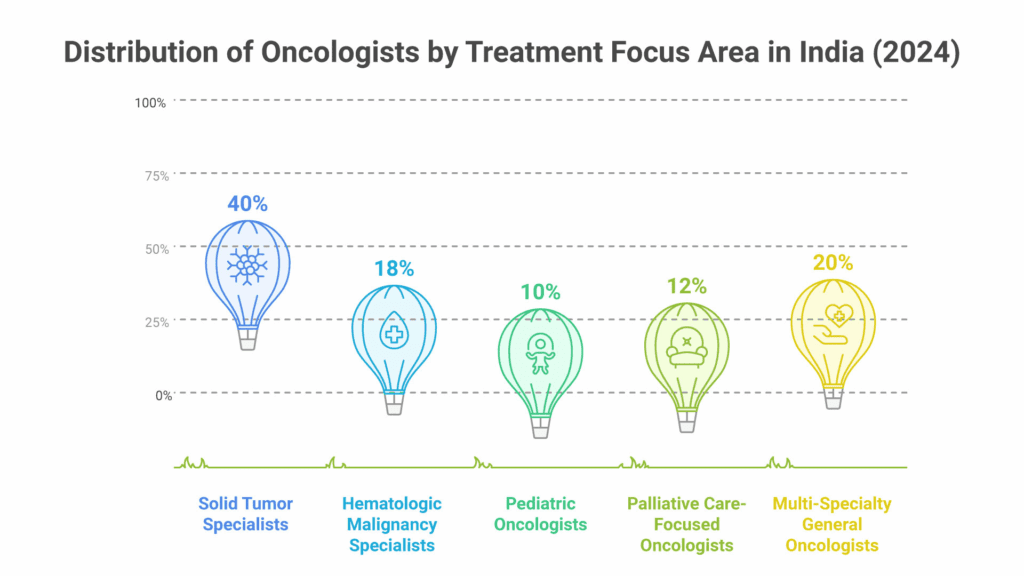

A recent 2024 survey conducted by the Indian Oncology Care Patterns Study Group highlights the following distribution of oncologists’ primary treatment focus areas across India:

Implications for Pharma Marketing Strategy:

- Solid Tumor Specialists prioritize information on targeted therapies, immunotherapies, and the latest ASCO/ESMO guideline updates.

- Hematologic Oncologists require data on CAR-T, novel biologics, and hematology-specific diagnostic advancements.

- Pediatric Oncologists focus on formulations suitable for children, long-term survivorship programs, and pediatric-specific clinical trials.

- Palliative Care Oncologists seek support tools for symptom management, end-of-life care training modules, and patient counseling resources.

- Multi-Specialty Oncologists value concise cross-domain updates, practical treatment flowcharts, and multi-indication drug information.

Campaign Design Recommendation:

Pharma brand managers must now segment not just by geography but also by therapeutic focus. CRM tools should be programmed to detect the oncologist’s dominant practice area and personalize outreach accordingly. Solid tumor specialists should receive tumor-specific trial data, while hematologists need updates on leukemia and lymphoma therapies. Pediatric oncologists would benefit from child-friendly dosing content, and palliative specialists require materials on supportive care drugs. This granular, focus-driven marketing approach will help pharma brands stay clinically relevant and build long-term trust across the Indian oncology community.

Section 5: Building Modular Microlearning Modules for Time-Starved Oncologists

In the fast-paced world of oncology, time is a critical constraint. Oncologists often juggle packed OPDs, tumor board meetings, patient counseling sessions, and research commitments, all within a single day. This leaves little room for long-format learning modules or webinars.

Recognizing this, pharma marketers are now adopting a microlearning strategy, delivering clinically relevant content in short, actionable formats that fit into 5–10-minute learning windows.

Popular Microcontent Formats Gaining Traction:

- 60-Second Video Nuggets: Quick takes on drug sequencing or new guideline updates (e.g., “How to Sequence Therapy After Progression on First-Line TKI”).

- Quick Diagnostic Quizzes: Interactive, mobile-based questions like “Is Your Patient Eligible for Maintenance Therapy?”

- Flashcards: Summaries of side-effect management protocols for common chemotherapies.

- SMS/WhatsApp Alerts: Instant updates on DCGI drug approvals, safety label changes, or new dosing guidelines.

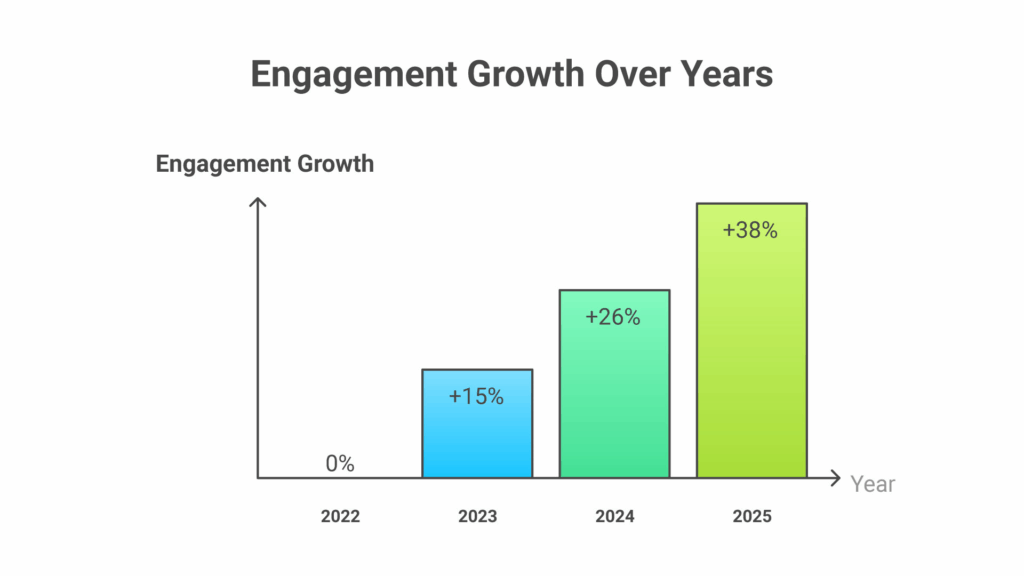

Engagement Trend:

According to MedInsights India 2025, oncologist engagement with short-form, mobile-optimized pharma content has grown dramatically:

This trend highlights a clear message for brand managers: Brevity and relevance drive adoption. Delivering value-packed microcontent, timely and accessible, can significantly boost pharma-HCP engagement in oncology.

Section 6: Enabling Oncologist-to-Patient Communication

Supporting oncologists in patient conversations has become a key pharma role.

Pharma-Supported Patient Communication Tools:

- Disease explainer animations (in regional languages).

- Printable checklists for chemotherapy preparation.

· Patient FAQs for typical therapy questions that are available on WhatsApp.

- Caregiver burnout recognition guides.

Case Example:

For a breast cancer launch, one pharma brand developed a “Patient Understanding Toolkit”, distributed via QR codes during OPD visits. Result: Over 5,000 patient downloads within 2 months.

Section 7: The Rise of Digital Tumor Boards and Peer-Learning Platforms

Oncologists increasingly seek peer validation and local case discussions.

Pharma’s Role:

- Sponsor and co-host tumor board series (physical + virtual hybrid).

- Facilitate cross-city case discussions.

- Integrate real-world patient scenarios using anonymized data.

Benefits for Pharma:

- Direct insights into practice gaps.

- Real-time feedback on clinical challenges.

- Opportunity to position brands within evidence-based discussions.

Tip: Involve local KOLs to anchor such programs for higher engagement.

Section 8: Real-World Evidence (RWE) Storytelling for Local Clinical Relevance

Section 8: Real-World Evidence (RWE) Storytelling for Local Clinical Relevance

In today’s oncology practice, randomized controlled trial (RCT) data, though essential, is no longer enough. Oncologists now demand insights that reflect real-world patient outcomes, especially from similar demographic, ethnic, and clinical settings.

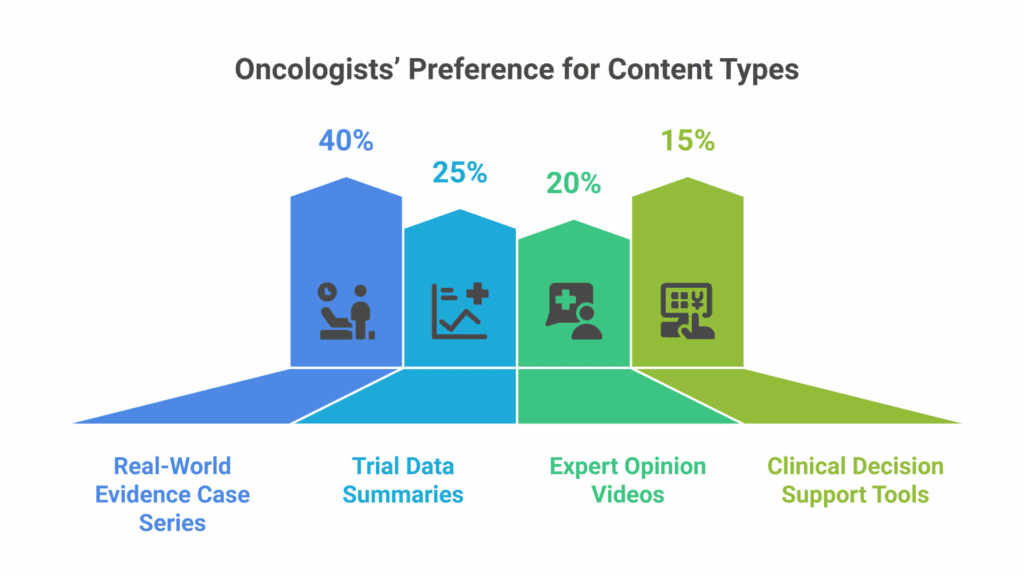

A survey by Oncology Insights India (2025) revealed shifting content preferences among Indian oncologists when it comes to clinical data consumption:

- Real-World Evidence (RWE) Case Series: 40%

- Trial Data Summaries: 25%

- Expert Opinion Videos (Local Clinicians): 20%

- Clinical Decision Support Tools: 15%

This data underscores a growing appetite for India-centric patient experiences and treatment outcomes.

Key RWE Formats That Resonate:

- Regional Case Series Reports: For example, a publication titled “Real-World Safety Profile of XYZ Drug in North Indian NSCLC Patients” offers contextually relevant insights for practitioners in similar regions.

- Trial vs Real-World Infographics: Simple, visual formats comparing trial data (e.g., progression-free survival rates) with actual patient outcomes in Indian oncology centers.

- Expert Video Panels: Short discussions (5–7 minutes) where Indian oncologists share their patient management experiences, tolerability observations, and dosing modifications from real-world use.

· The lesson for pharmaceutical marketers is straightforward: To increase engagement and establish scientific credibility with oncologists, data storytelling needs to be localized, personalized, and reflect realities of everyday practice.

Section 9: Integrating Field Reps, MSLs, and Digital Ecosystem

Digital shouldn’t replace field reps; it should amplify their effectiveness.

New Model: Hybrid HCP Engagement

- Reps track HCP digital interactions before clinic visits.

- MSLs follow up on clinical queries emerging from online tools.

- Pharma CRM syncs all touchpoints (email clicks, tool downloads, webinar attendance).

Example Workflow:

Oncologist downloads a “Side Effect Management Guide” → Rep schedules a focused discussion → MSL provides deeper clinical literature.

Result: Targeted, needs-based detailing rather than generic pitches.

Section 10: Localized Content Production for India’s Oncology Diversity

Why Local Matters:

- 65% of oncologists prefer regional patient case examples.

- Regional language patient materials boost engagement by up to 40%.

- Videos featuring Indian KOLs get 2x more views than global speaker content.

Recommended Content Types:

- Hindi/Marathi/Tamil patient explainer videos.

- Infographics featuring India-specific incidence rates.

- Webinars co-hosted with regional oncologists.

Section 11: Utilizing WhatsApp & Telegram as Serious HCP Channels

Gone are the days when WhatsApp was considered too informal for medical discussions.

WhatsApp-Based Pharma Initiatives:

- Clinical update series.

- Monthly quiz contests with CPD points.

- Peer-to-peer tumor case polls.

Compliance Tip:

Ensure opt-in consent and use encrypted, HCP-only groups to maintain ethical boundaries.

Section 12: Building Digital Ad Boards and Feedback Loops

Digital Advisory Boards (Ad Boards) now offer cost-effective, high-frequency feedback channels.

Format Examples:

- Quarterly surveys on clinical gaps.

- Polls on new content formats.

- Online forums for product positioning discussions.

Benefits:

- Short turnaround times.

- Geographically diverse HCP input.

- Data-backed refinement of marketing strategies.

Section 13: Gamification of Learning for Busy Oncologists

Gamified content drives higher engagement and knowledge retention.

Ideas:

- Treatment decision tree simulators.

- Case-based learning modules with leaderboards.

- Certification-based micro-courses.

Example:

A pharma company launched an “Oncology Decision Challenge App”, where oncologists competed by solving weekly clinical scenarios. Result: 48% completion rate, 3x higher than traditional webinars.

Section 14: Beyond Promotion; Driving Health System Impact Metrics

Pharma companies are now being judged not just on product uptake but also on broader health system impact.

Key Impact Metrics:

- Increase in biomarker testing rates.

- Reduction in patient drop-off from first to second-line treatment.

- Improved treatment adherence (measured via refill data).

- Increase in early diagnosis referrals.

Case Example:

A lung cancer campaign embedded “Referral Readiness Checklists” in primary care settings. Outcome: 18% increase in early-stage diagnosis referrals over 6 months.

Section 15: Preparing for Voice & Conversational AI in Oncology Marketing

While AI-driven tools were the focus of last-generation strategies, voice-based engagement is the new horizon.

Emerging Ideas:

- Alexa-based oncology guidelines summaries.

- Voicebots answering FAQs on drug indications.

- HCP voice-search-optimized content.

Adoption Challenge:

· Oncologists remain cautious about adopting voice-based tools, emphasizing the need for scientific accuracy, clinical relevance, and strict regulatory compliance to ensure patient safety and maintain trust in digital clinical decision support systems.

Section 16: Rethinking KPIs for Oncology Digital Marketing

Old digital KPIs like “email open rates” or “click counts” are now largely irrelevant in oncology.

Meaningful New KPIs:

- Average time-on-tool per user.

- Percentage of returning HCP visitors.

- Number of

- HCP satisfaction ratings post-interaction. downloads for patient materials.

- Change in therapy adoption curve after campaign exposure.

Conclusion: Pharma Must Evolve from Marketer to Clinical Ally

In the high-stakes world of oncology, where every treatment choice can alter the course of a patient’s life, pharma marketing must transcend traditional promotional tactics. It’s no longer about pushing brand visibility, it’s about enabling better patient care.

The future of oncology engagement lies in creating tools that empower clinical decision-making, delivering educational value, and supporting oncologists in real-world practice scenarios. Pharma must shift from being a message broadcaster to becoming a trusted clinical partner.

By providing decision aids, localized real-world evidence, patient education resources, and time-saving microcontent, pharma brands can integrate seamlessly into the oncologist’s workflow.

This mindset shift, from visibility-driven outreach to value-driven engagement, will define tomorrow’s market leaders. Those who embrace this change will not only grow prescription share but also build enduring trust and long-term relationships within the oncology community.

The Oncodoc team is a group of passionate healthcare and marketing professionals dedicated to delivering accurate, engaging, and impactful content. With expertise across medical research, digital strategy, and clinical communication, the team focuses on empowering healthcare professionals and patients alike. Through evidence-based insights and innovative storytelling, Hidoc aims to bridge the gap between medicine and digital engagement, promoting wellness and informed decision-making.